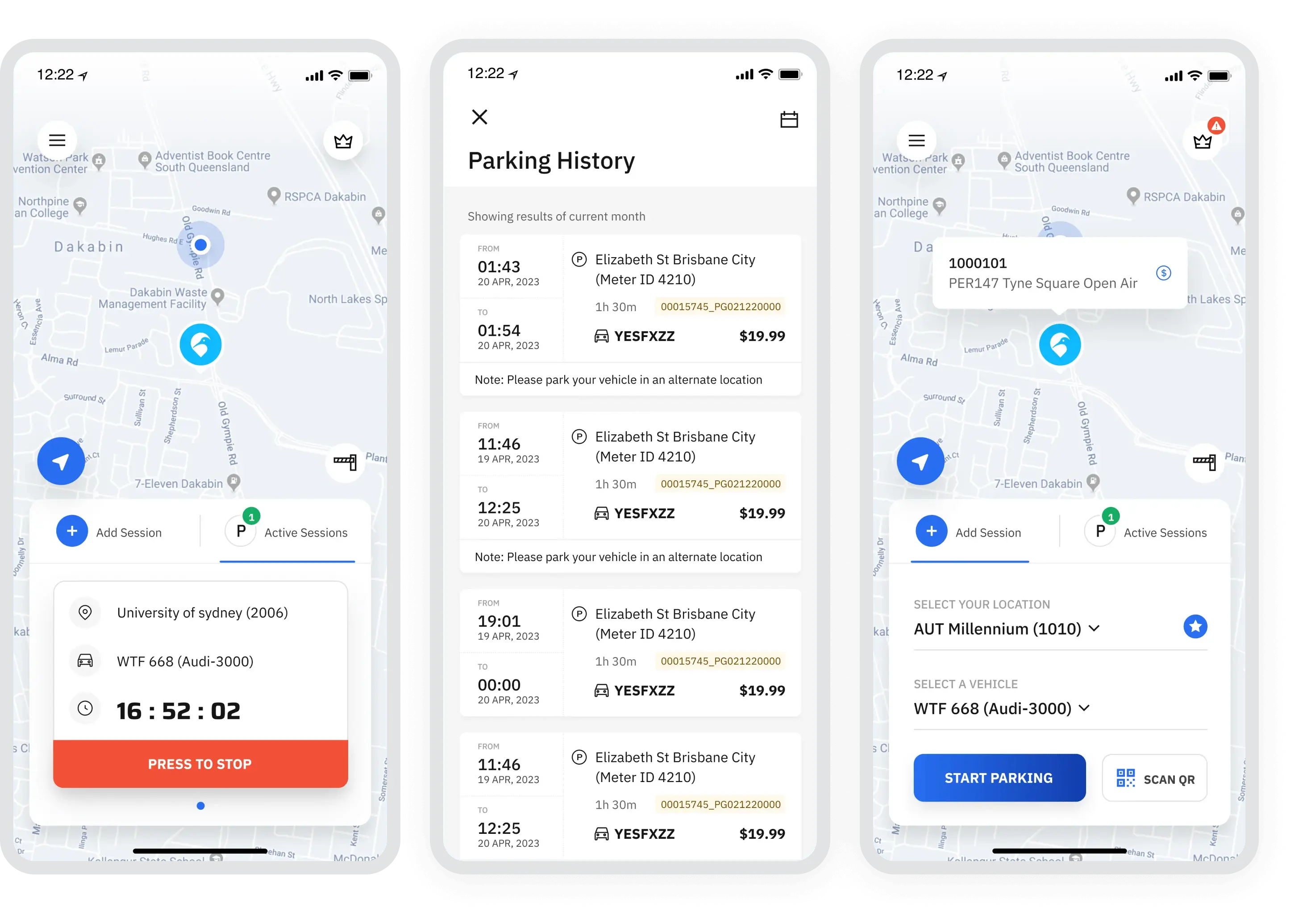

ParKiwi app allows users to pay-by-phone solutions for their parking at the facilities at various cities and universities across Australia, NewZealand and US.

x-enabler is your unfair advantage to supercharge your technology business. We help companies develop tech products, raise capital, and scale their business.

Meet Our Team

x-enabler is led by a team of perfect duo that can help you take your business to the next level.

Prashant Gami

Two decades of tech dominance. From idea inception to multimillion dollar business behemoths.

Tony Singh

20+ years of strategic roadmaps, business development, fundraising and investor managementPortfolio

See how we have enabled companies from various industries build a robust & scalable business.

Parkiwi

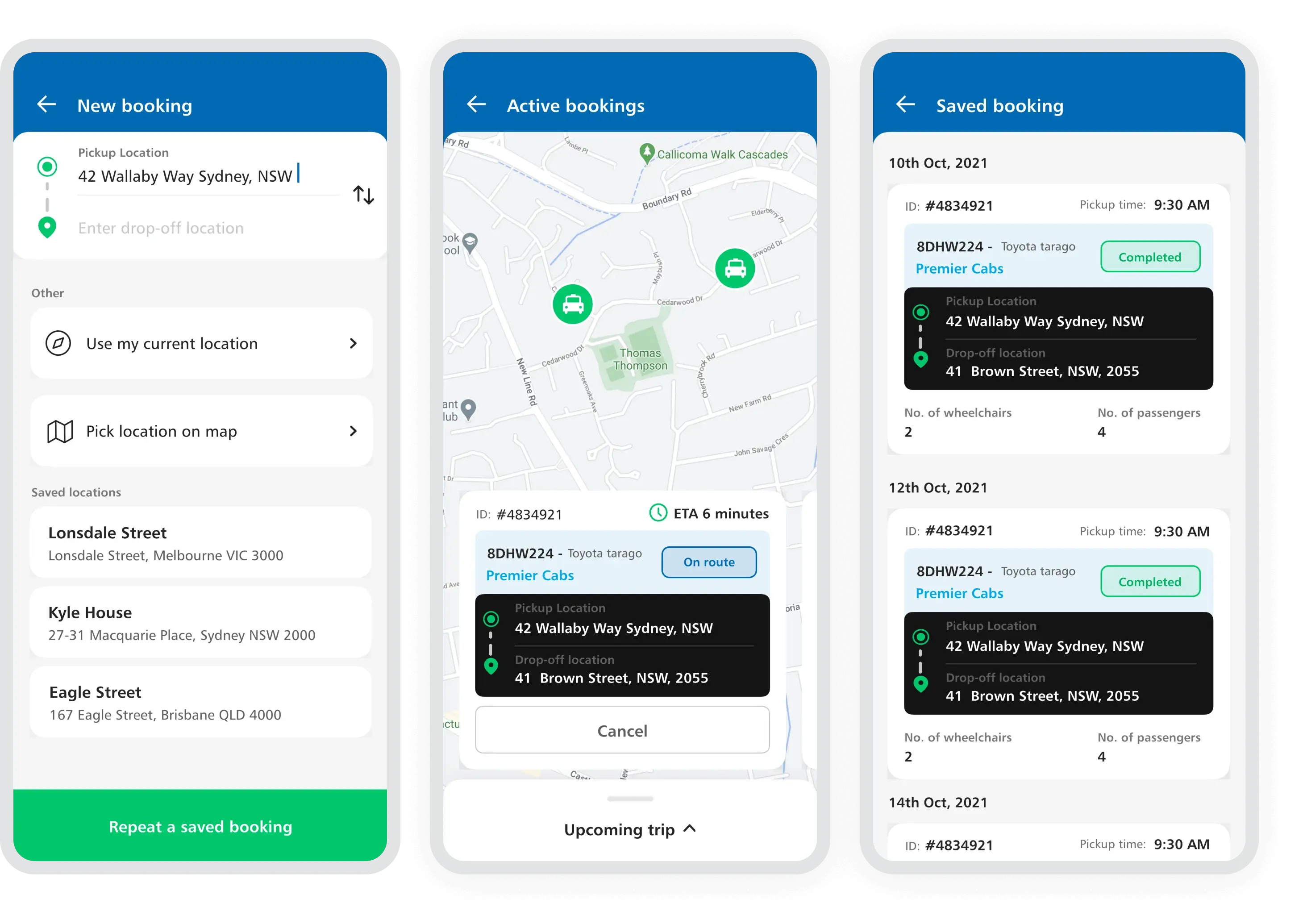

Wheelchair Book & Ride

A smart, real-time, location-based, centralised booking system for wheelchair accessible taxis in the Sydney metropolitan area, making it easier to secure an accessible ride in a suitable vehicle.

- Platform created and launched within 5 months.

- Connected all the accessible taxi providers across Sydney metro.

- Reduction of average waiting time from 2.5 hours to 20 mins.

- Capability to book in advance for 30 days.

- 100% accessible solution.

Give a Minute

Give a Minute is a Unicef Campaign site, used in their money raising campaigns at the events. The campaigns are highly configurable based on the events, causes and other business needs.

CABN: Assets supporting cabin homes

EcoCabins, an innovative company specializing in the construction and leasing of eco-friendly modular homes known as EcoCabins, has successfully raised $25 million in capital. This significant investment highlights the growing demand for sustainable housing solutions and the increasing recognition of EcoCabins' unique value proposition.

Irish Oracle

IrishOracle is a gamified community experience for a NFT community that allows members to redeem the tokens in a gamified way. This web app connects NFT scanning with NFT redeem workflow with purgatory implementation.

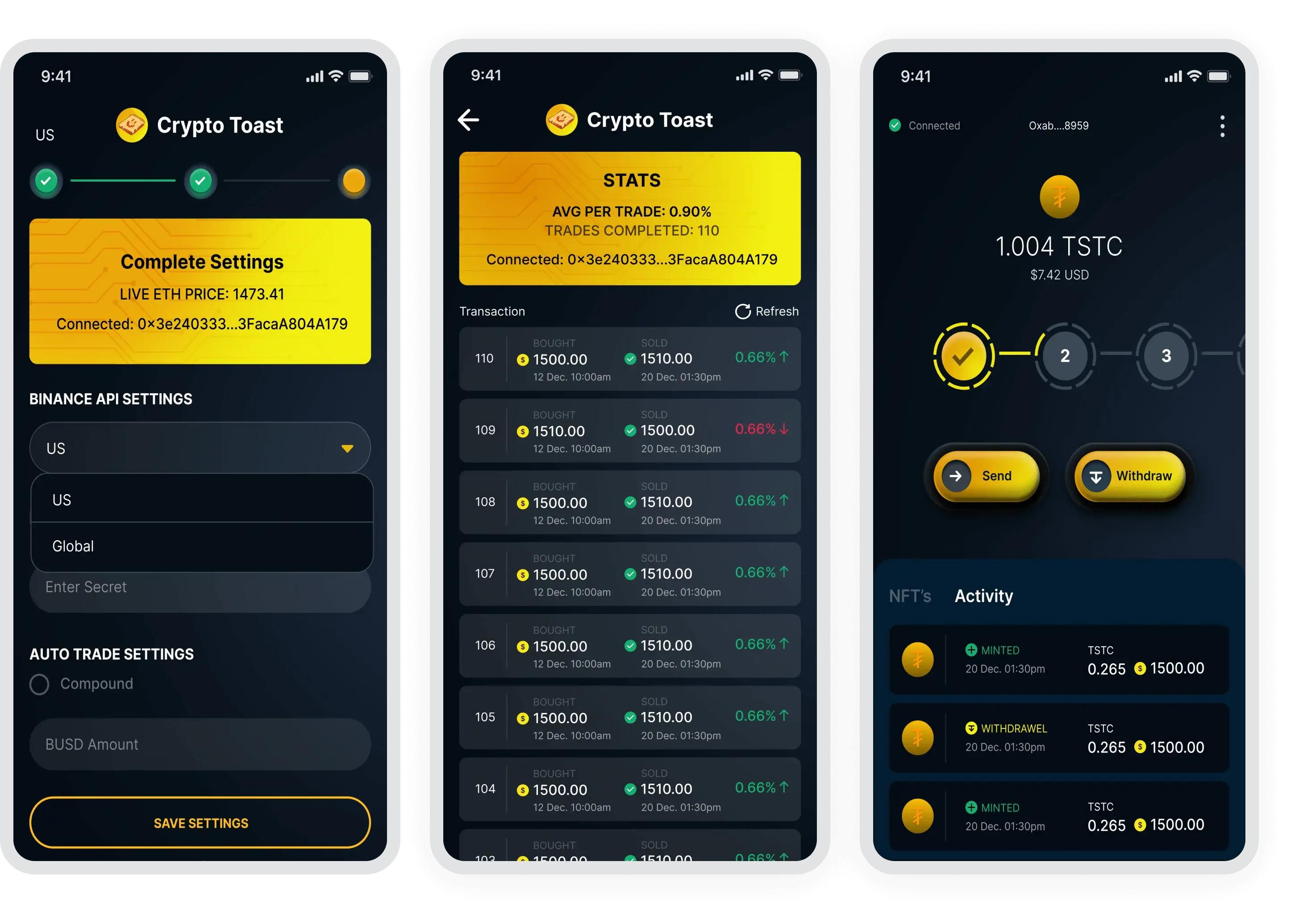

Crypto Toast

CryptoToast is a trading bot that allows you to plug in trading algorithms with TradingView and Binance to automatically trade BTC or eth using USDC and USDT.

Testimonials

People cheers for us! Find out how our users are spreading the word!

“xenabler does not only deliver a product to your requirements but they also do a massive effort to understand your business needs and make sure the user experience and the functional elements of the product are top-notch.”

Shmulik Kahlon

ParKiwi“xenabler has been a pivotal member of Cared Australia journey allowing us to enable our B2C solution in lean and agile way.”

Mehul Shah

Cared Australia“xenabler team has been a key part of this journey delivering mobile solutions that made this journey possible.”

Sivan Atad

So-E Australia“xenabler is a strong partner who helped us building job management system across various platforms. They know the value of money and time for market.”

Ali Khan

TradieCom“Outstanding team with great work ethic and first-class customer service. I highly recommend their services to anyone requiring mobile app development skills.”

Adrian Mascia

Wheelchair Book & Ride“Gami and his team at xEnabler were instrumental in helping us build and launch our mobile apps quickly and at an affordable startup cost.”

Sivan Atad

The Gifted“If you want it done good, there are plenty of developers available. But if you want it done right choose x-enabler. Thank you Prashant and the team for always being present for us and we look forward to our continued journey together!”

Matthew Ng

RacerClub“My honest experience with x-enabler, they had helped me till today with some of the most challenging projects that most developers can’t wrap their heads around. Thanks x-enabler team!!”

Matthew Ng

Crypto Toast“Being in the web3 space for over two years now I have been through my far share of developers. Some good, some okay, and some outright terrible. x-enabler is not only good, but an outstanding team that has helped me till today.”